The tax system in the USA

Taxes are money that citizens and residents should pay to the federal, state and local governments. Taxes come to the government to pay for government services and to maintain benefits under various government programs. For more information on where taxes are directed, visit the National Priorities Project website.

U.S. citizens or permanent residents are required to file regular income tax returns by reporting their income to the Internal Revenue Service (IRS) and their state and city tax authorities. Thus, three levels of tax returns must be filed each year:

- Federal Taxes directed to the U.S. Internal Revenue Service

- State Taxes directed to the State Tax Service

- Local / City Taxes directed to the City Tax Service

The tax return must be filled in every year, even if you have no income. You must do this for the purpose of reporting: You may be given a refund instead of tax because of the many benefits provided by the IRS, state, or city code. IRS has a strong track record of tax compliance, and violations of the code are strictly punishable by law. If you need some help with this issue, you can use the services of a company that can help you with southwest tax https://southwesttaxassociates.com/. It is a great option for some big companies that always have problems with the tax return.

The tax return must include your earnings from January to December of the previous year. It is important to submit it by April 15 of this year.

If you do not submit your tax return on time or if you provide incorrect information in your tax return, you may have some problems. Always keep tax returns reports for the last 3 years. Every year, Internal Revenue Service conducts random checks and you may need to submit reports to prove that you have paid taxes. Moreover, if you are in the process of naturalization, USCIS may request copies of your tax reports for the last 5 years.

Three important factors affect your income tax rate:

- Income. This includes salary, dividends, alimony, business income, pension, etc. The more you get, the higher the tax rate will be.

- Marital status. There are family categories such as single, married and head of household, and the tax rate for each category is different.

- Dependents. This category includes children and elderly parents who live with you. The state provides a tax discount and loans for each dependent person.

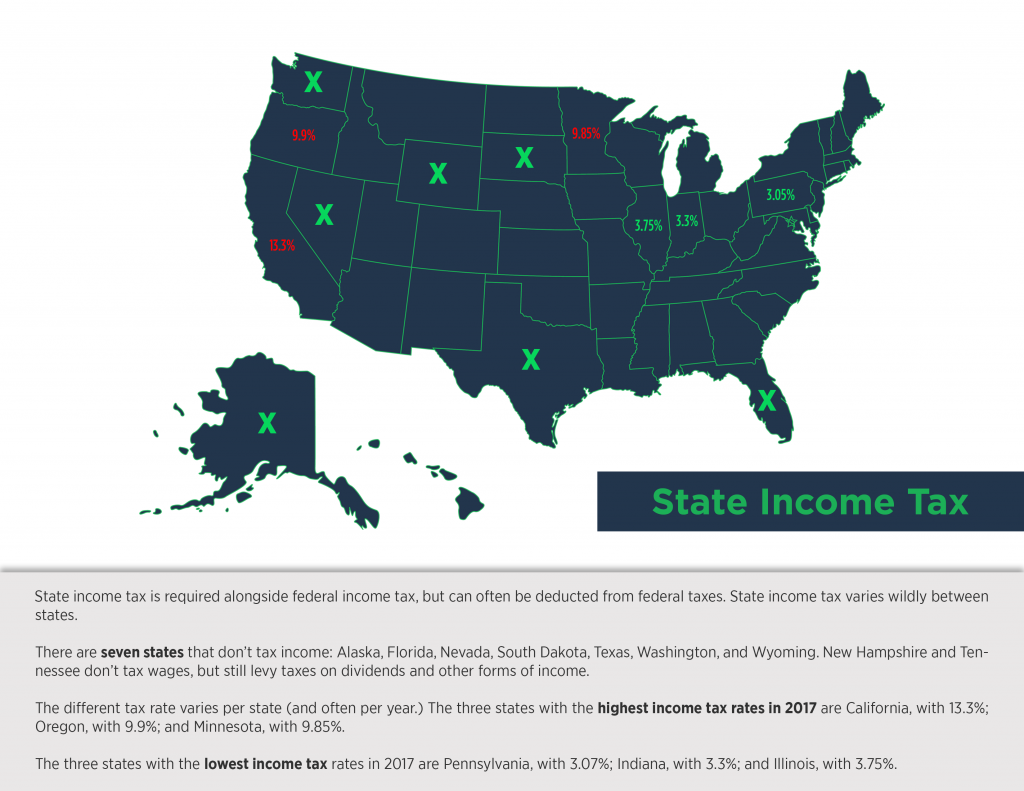

Keep in mind that personal income tax is paid under a three-level system – federal, state, and local taxes, which we have already discussed in this article. All residents and U.S. citizens must pay federal income tax, but some states or cities do not charge income tax.

In addition to the factors listed above, the tax rate is influenced by other factors that occur at the time of filing the tax return. For instance, moving because of a change of job, a loan or business profits may reduce or increase your tax rate.